Background ^

Since 2012 BitFolk has been using GoCardless as a Direct Debit payment provider. On the whole it has been a pleasant experience:

- Their API is a pleasure to integrate against, having excellent documentation

- Their support is responsive and knowledgeable

- Really good sandbox environment with plenty of testing tools

- The fees, being 1% capped at £2.00, are pretty good for any kind of payment provider (much less than PayPal, Stripe, etc.)

Of course, if I was submitting Direct Debits myself there would be no charge at all, but BitFolk is too small and my bank (Barclays) are not interested in talking to me about that.

The “Pro” API ^

In September 2014 GoCardless came out with a new version of their API called the “Pro API”. It made a few things nicer but didn’t come with any real new features applicable to BitFolk, and also added a minimum fee of £0.20.

The original API I’d integrated against has a 1% fee capped at £2.00, and as BitFolk’s smallest plan is £10.79 including VAT the fee would generally be £0.11. Having a £0.20 fee on these payments would represent nearly a doubling of fees for many of my payments.

So, no compelling reason to use the Pro API.

Over the years, GoCardless made more noise about their Pro API and started calling their original API the “legacy API”. I could see the way things were going. Sure enough, eventually they announced that the legacy API would be disabled on 31 October 2017. No choice but to move to the Pro API now.

Payment caps ^

There aren’t normally any limits on Direct Debit payments. When you let your energy supplier or council or whatever do a Direct Debit, they can empty your bank account if they like.

The Direct Debit Guarantee has very strong provisions in it for protecting the payee and essentially if you dispute anything, any time, you get your money back without question and the supplier has to pursue you for the money by other means if they still think the charge was correct. A company that repeatedly gets Direct Debit chargebacks is going to be kicked off the service by their bank or payment provider.

The original GoCardless API had the ability to set caps on the mandate which would be enforced their side. A simple “X amount per Y time period”. I thought that this would provide some comfort to customers who may not be otherwise familiar with authorising Direct Debits from small companies like BitFolk, so I made use of that feature by default.

This turned out to be a bad decision.

The main problem with this was that there was no way to change the cap. If a customer upgraded their service then I’d have to cancel their Direct Debit mandate and ask them to authorise a new one because it would cease being possible to charge them the correct amount. Authorising a new mandate was not difficult—about the same amount of work as making any sort of online payment—but asking people to do things is always a pain point.

There was a long-standing feature request with GoCardless to implement some sort of “follow this link to authorise the change” feature, but it never happened.

Payment caps and the new API ^

The Pro API does not support mandates with a capped amount per interval. Given that I’d already established that it was a mistake to do that, I wasn’t too bothered about that.

I’ve since discovered however that the Pro API not only does not support setting the caps, it does not have any way to query them either. This is bad because I need to use the Pro API with mandates that were created in the legacy API. And all of those have caps.

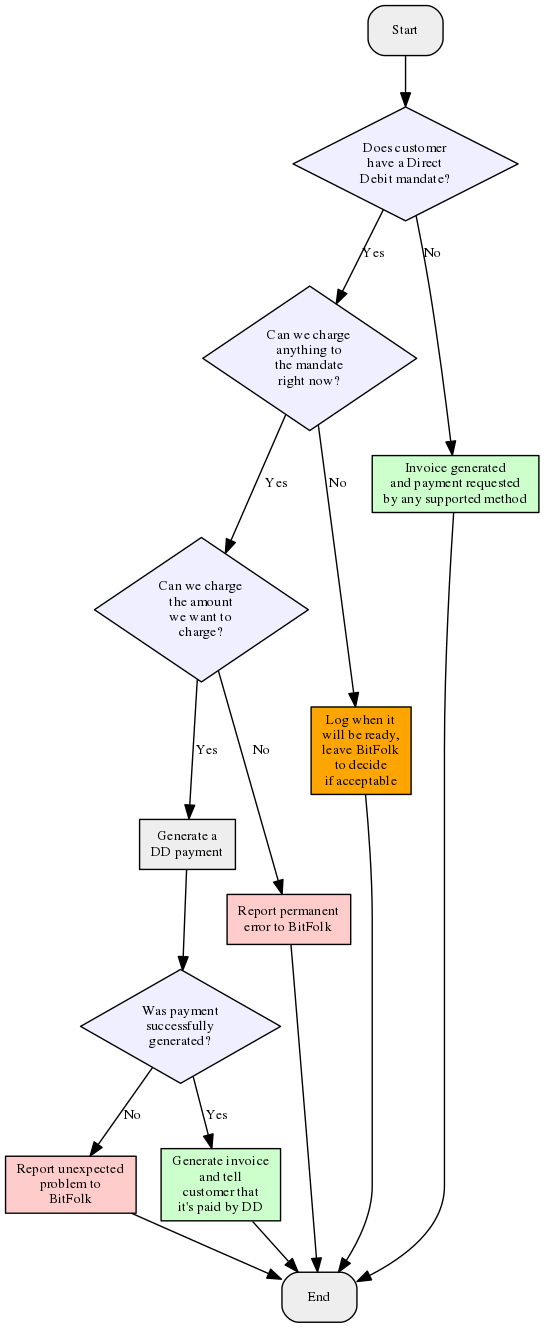

Here’s the flow I had using the legacy API.

This way if the charge was coming a little too early, I could give some latitude and let it wait a couple of days until it could be charged. I’d also know if the problem was that the cap was too low. In that case there would be no choice but to cancel the customer’s mandate and ask them to authorise another one, but at least I would know exactly what the problem was.

With the Pro API, there is no way to check timings and charge caps. All I can do is make the charge, and then if it’s too soon or too much I get the same error message:

“Validation failed / exceeds mandate cap”

That’s it. It doesn’t tell me what the cap is, it doesn’t tell me if it’s because I’m charging too soon, nor if I’m charging too much. There is no way to distinguish between those situations.

Backwards compatible – sort of ^

GoCardless talk about the Pro API being backwards compatible to the legacy API, so that once switched I would still be able to create payments against mandates that were created using the legacy API. I would not need to get customers to re-authorise.

This is true to a point, but my use of caps per interval in the legacy API has severely restricted how compatible things are, and that’s something I wasn’t aware of. Sure, their “Guide to upgrading” does briefly mention that caps would continue to be enforced:

“Pre-authorisation mandates are not restricted, but the maximum amount and interval that you originally specified will still apply.”

That is the only mention of this issue in that entire document, and that statement would be fine by me, if there would have continued to be a way to tell which failure mode would be encountered.

Thinking that I was just misunderstanding, I asked GoCardless support about this. Their reply:

Thanks for emailing.

I’m afraid the limits aren’t exposed within the new API. The only solution as you suggest, is to try a payment and check for failure.

Apologies for the inconvenience caused here and if you have any further queries please don’t hesitate to let us know.

What now? ^

I am not yet sure of the best way to handle this.

The nuclear option would be to cancel all mandates and ask customers to authorise them again. I would like to avoid this if possible.

I am thinking that most customers continue to be fine on the “amount per interval” legacy mandates as long as they don’t upgrade, so I can leave them as they are until that happens. If they upgrade, or if a DD payment ever fails with “exceeds mandate cap” then I will have to cancel their mandate and ask them to authorise again. I can see if their mandate was created before ~today and advise them on the web site to cancel it and authorise it again.

Conclusion ^

I’m a little disappointed that GoCardless didn’t think that there would need to be a way to query mandate caps even though creating new mandates with those limits is no longer possible.

I can’t really accept that there is a good level of backwards compatibility here if there is a feature that you can’t even tell is in use until it causes a payment to fail, and even then you can’t tell which details of that feature cause the failure.

I understand why they haven’t just stopped honouring the caps: it wouldn’t be in line with the consumer-focused spirit of the Direct Debit Guarantee to alter things against customer expectations, and even sending out a notification to the customer might not be enough. I think they should have gone the other way and allowed querying of things that they are going to continue to enforce, though.

Could I have tested for this? Well, the difficulty there is that the GoCardless sandbox environment for the Pro API starts off clean with no access to any of your legacy activity neither from live nor from legacy sandbox. So I couldn’t do something like the following:

- Create legacy mandate in legacy sandbox, with amount per interval caps

- Try to charge against the legacy mandate from the Pro API sandbox, exceeding the cap

- Observe that it fails but with no way to tell why

I did note that there didn’t seem to be attributes of the mandate endpoint that would let me know when it could be charged and what the amount left to charge was, but it didn’t set off any alarm bells. Perhaps it should have.

Also I will admit I’ve had years to switch to Pro API and am only doing it now when forced. Perhaps if I had made a start on this years ago, I’d have noted what I consider to be a deficiency, asked them to remedy it and they might have had time to do so. I don’t actually think it’s likely they would bump the API version for that though. In my defence, as I mentioned, there is nothing attractive about the Pro API for my use, and it does cost more, so no surprise I’ve been reluctant to explore it.

So, if you are scrambling to update your GoCardless integration before 31 October, do check that you are prepared for payments against capped mandates to fail.